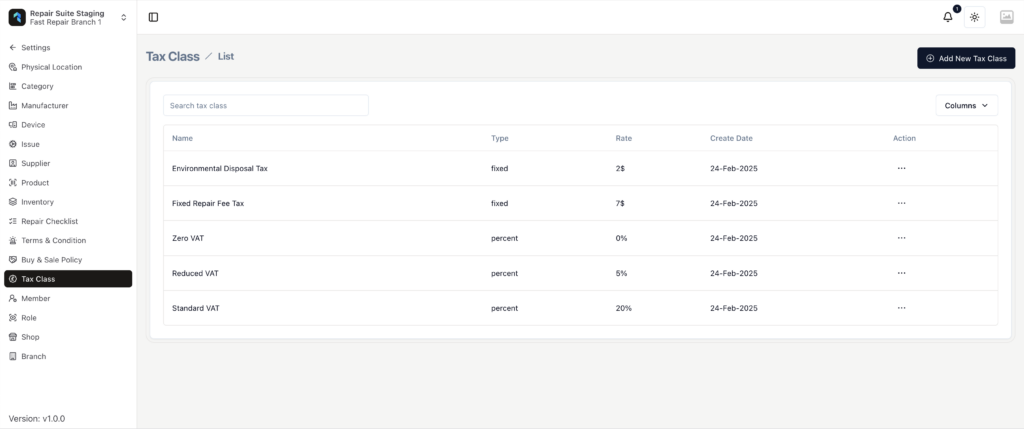

The Tax Class Management feature in RepairSuite allows you to set up and manage different tax rates for your repair services and products. You can configure tax classes based on percentage-based VAT or fixed fees, ensuring compliance with local tax regulations.

Accessing Tax Class Management #

- From the left sidebar, navigate to: Settings → Tax Class

- You will see the Tax Class List, which may be empty if no tax classes have been added yet.

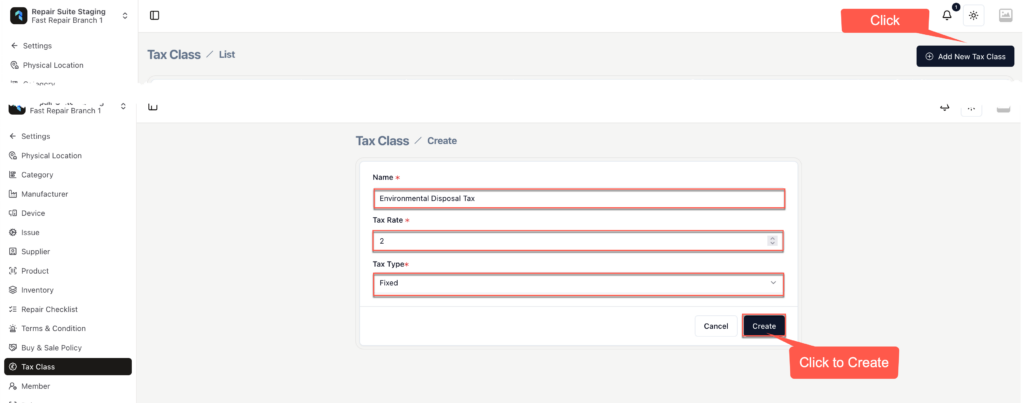

Adding a New Tax Class #

- Click the “Add New Tax Class” button in the top-right corner.

- You will be taken to a new page to enter tax details.

- Fill in the required fields:

- Tax Name* – Name of the tax (e.g., Standard VAT, Zero VAT).

- Rate* – Specify the tax rate (percentage or fixed amount).

- Type* – Choose Fixed (set amount) or Percent (percentage of the price).

- Click “Create” to save the tax class.

Example Tax Classes

| Tax Name | Tax Rate | Tax Type | Description |

| Standard VAT | 20% | Percent | Applies to most goods and services, including mobile and laptop repairs. |

| Reduced VAT | 5% | Percent | Applies to some energy-saving products or services. Not typically applicable to repair services, but may be needed for specific cases. |

| Zero VAT | 0% | Percent | Applies to certain goods and services, such as some refurbished devices or exports outside the UK. |

| Fixed Repair Fee Tax | £5 | Fixed | A fixed service tax applied per repair job instead of a percentage. |

| Environmental Disposal Tax | £2 | Fixed | Could be used for waste disposal or recycling fees for electronic parts. |

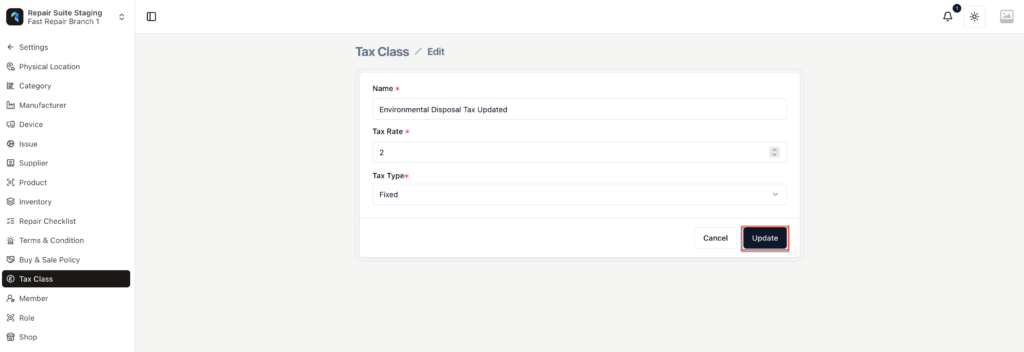

Editing a Tax Class #

- Navigate to Settings → Tax Class.

- Locate the tax class you want to update.

- Click the three-dot menu (⋮) next to the tax class and select “Edit”.

- Modify the name, rate, or type, then click “Update” to save the changes.

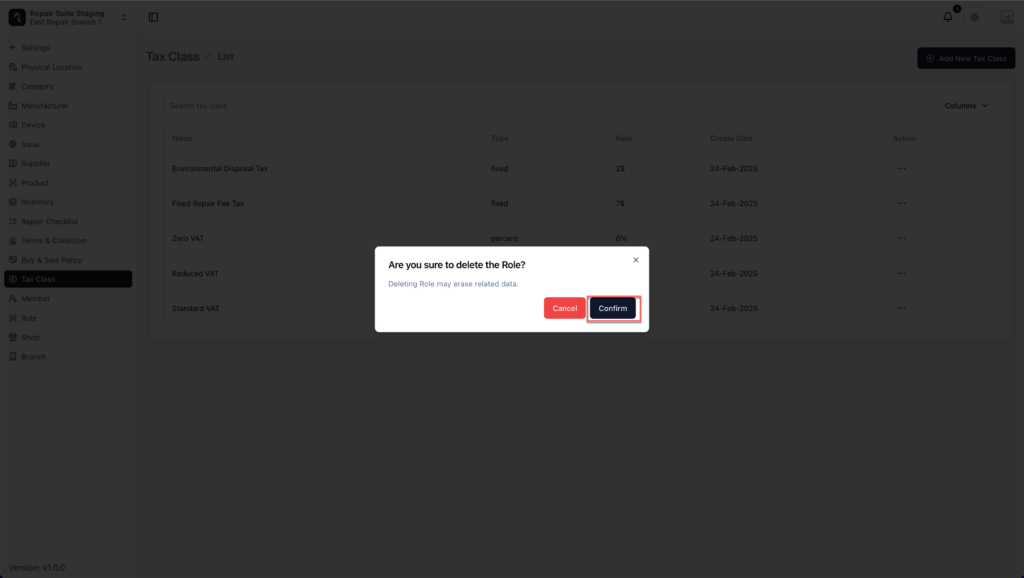

Deleting a Tax Class #

⚠️ Warning: Deleting a tax class is permanent and cannot be undone.

- Go to Settings → Tax Class.

- Click the three-dot menu (⋮) next to the tax class you wish to delete.

- Select “Delete”, and confirm the deletion when prompted.